Capital is the fuel that enables new businesses to emerge, existing businesses to expand, and troubled businesses to recover. Our ability to structure, negotiate, and document a vast array of financial arrangements facilitates the transactions that deliver that fuel.

From multi-million-dollar financing deals to multi-billion-dollar workouts, whatever the nature of the financing, whatever the scope of the deal, Venable attorneys know how to make it happen. We assist public and private companies, financial institutions, government entities, and others in sophisticated corporate, public, and real-estate finance matters throughout the United States.

Experienced Counsel Across an Array of Finance Transactions

Acquisition Finance

Acquisitions require financing suited to the deal. We help you formulate the right financial structure and then ensure it is properly documented and executed. Our experience includes direct purchases, loans, equity and other direct investments, credit enhancements, and divestitures.

We represent public companies and private equity firms of all sizes in debt and equity transactions. Our clients range from emerging businesses to large national and international corporations. They span industries that include finance, manufacturing, real estate, hospitality, healthcare, pharmaceuticals, transportation, mass media, and information technology.

Corporate Finance and Securities

In corporate finance, there is no shortcut to experience. Venable's attorneys have a long history of representing clients in all varieties of capital markets transactions. Our experience extends across industries and includes financial services, technology, and life sciences, among others.

In this realm, we advise underwriters and issuers in public offerings, including IPOs and preferred stock offerings. We counsel both lenders and borrowers in 144A transactions, and we represent numerous public companies and private equity firms in the structuring of sophisticated acquisition vehicles and mezzanine debt investments. From start-ups to seasoned public issuers, we help companies raise capital in public and private equity and debt financings, including through the sale of preferred stock to venture capital investors.

Junior Capital and Mezzanine Financing

The negotiation and structuring of junior capital and mezzanine finance deals require counsel that is intimately familiar with the complex and time-sensitive nature of such transactions. We work with lenders, investors, and issuers to evaluate options for junior capital and mezzanine financing and then to structure and close the transaction. The lenders we represent are most often mezzanine funds and private equity groups, including SBICs. The transactions are both secured and unsecured, with equity (including warrants) and without.

A key aspect of our practice is negotiating subordination and intercreditor agreements with senior lenders and advising lenders on post-investment issues, including restructurings. Nationally, we work with major banks and funds on loans valued at many millions of dollars. We also work with regional funds that serve the more modest needs of smaller businesses.

Loan Workouts, Restructurings, and Distressed Assets

Venable attorneys have been involved in some of the largest bankruptcy cases in the United States. We represent banks, major corporations, and government entities in national and regional cases. We also represent major secured and unsecured creditors in out-of-court workouts, foreclosures, and liquidations.

Our practice includes work for buyers and sellers of assets in bankruptcy cases in any jurisdiction. We have significant nationwide experience representing both DIP and exit facility lenders, as well as debtors and debtors-in-possession in distressed industries.

In mortgage renegotiations, foreclosures, and deed in lieu of foreclosure negotiations, we regularly represent property owners, lenders, and special servicers in the renegotiation and, if necessary, foreclosure of troubled mortgages.

For entities seeking interpretation of complex debt structures in the context of asset-backed securitization, Venable is the go-to firm. Our capabilities include CDOs, CMBS loans, participation agreements, pari passu notes, and mezzanine agreements subordinated to securitized structures.

Public Finance

Venable has cultivated significant experience in guiding the financing of municipal, educational, healthcare, and cultural facilities.

Whether we are representing government issuers, 501(c)(3) corporation borrowers, or financial institutions, we work with our clients to create a plan that gets the deal done, within applicable constraints, in the most advantageous manner possible. We are able to implement a wide range of financing techniques, including tax credit structures, variable-rate debt, interest rate swaps, credit enhancement, and assorted refinancing techniques, always being mindful of the requirements of state and local law, federal tax law, and federal securities laws. Once the deal is completed, we provide ongoing compliance counsel. Working with our renowned team of tax attorneys, we advise on bond transactions, and provide counsel on compliance with IRS rules and regulations; we also assist our clients in complying with ongoing SEC disclosure requirements.

Public-private Partnerships

As jurisdictions across the country seek innovative ways of funding transportation projects, public-private partnerships have become an increasingly attractive option. Venable advises private sector clients as well as public agencies in the development of public-private partnerships in transportation infrastructure, including bridge, highway, and transit projects. Our team provides the financial, political, and legal insight needed in an acquisition or disposition of publicly owned assets and the perspective needed to structure relationships that recognize the strengths and needs of both sides in public-private partnerships.

From toll roads in Texas to transit projects in Virginia, Venable attorneys help private developers throughout the country structure equity and debt financing for their projects. We guide clients through the maze of federal and state regulatory, environmental, tax, and financing hurdles that too often delay or frustrate projects.

Real Estate Finance

Sound finance is the foundation of successful real estate development. No matter the kind of property or type of development, Venable is prepared to help.

Whether the plans call for an office building, hotel, shopping center, industrial plant, multifamily housing, or residential development, we provide a full range of financial counsel. For local, regional, and national clients, we handle financing transactions, acquisitions and sales, and development transactions. Venable has designed and represented national programs to dispose of multifamily real estate owned assets and defaulted multifamily real estate loans.

Our experience encompasses all types of loans, including mortgage financing, permanent, bridge and construction loans, mezzanine financing, and representation of equity participants in real estate transactions. We regularly consult with investors, lenders, and property owners to develop strategies for dealing with distressed real estate. During the past five years, we have overseen workouts involving loans backed by assets located in more than 40 different states and with individual asset values of more than $3.5 billion.

Structured Finance

Venable regularly represents participants in the asset-backed securities markets. We counsel clients in connection with structuring and negotiating complex financing transactions. Over the past two years, we have represented issuers of asset-backed securities, with an emphasis on mortgage-backed securities, totaling in excess of $4 billion.

Drawing on the multifaceted knowledge of attorneys in our Financial Services, Business Transactions, and Investment Management groups, we are prepared to address the full breadth of issues that arise during the course of structured finance transactions.

Our practice includes advising financial institutions in connection with structured finance products. As but one example, we represented a major financial institution over many years in its multifamily structured transactions. We actively participated in developing the client's structured transaction program and went on to negotiate and document more than 50 structured transactions having an aggregate loan amount in excess of $15 billion.

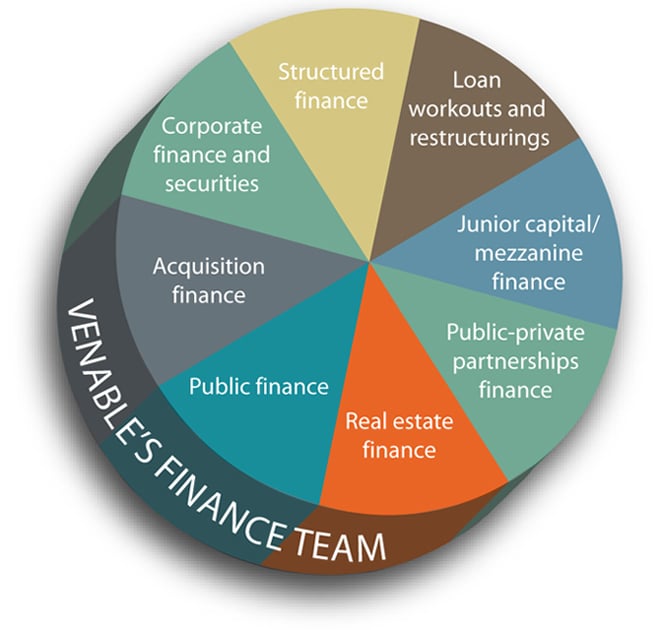

Practice Focus

- Acquisition finance

- Corporate finance and securities

- Junior capital/mezzanine finance

- Loan workouts and restructurings

- Public finance

- Public-private partnerships finance

- Real estate finance

- Structured finance

Industry Focus

- Financial services

- Government

- Healthcare

- Hospitality

- Information technology

- Mass media

- Real estate

- Transportation

Client Focus

- Banks and other financial institutions

- Government agencies

- Public companies

- Private equity firms

- Real estate developers

- Start-up companies