We’ll bring you several approaches to solve the problem—and lay out the advantages and the costs of each option. Not just legal solutions, but plans made by applying know-how and business judgment to what will work best for your organization.

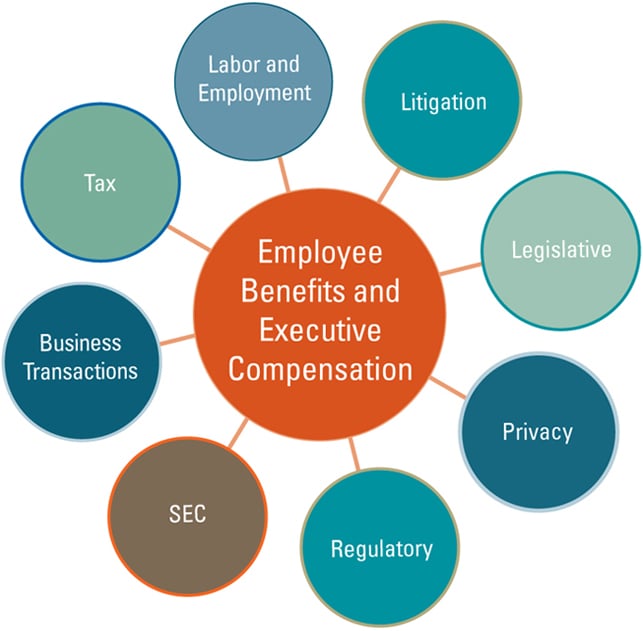

The rules governing employee benefit programs have become so incredibly complex that it’s the rare organization that can handle them on its own. We can help you meet that challenge. We bring specific employee benefits skills and experience in addition to related regulatory, tax, and political know-how, all seasoned with a healthy dose of practical reality.

We help you design integrated benefit packages—piecing together all types of retirement plans with health plans, life/disability insurance, education assistance, and work-balance programs—that fit your business goals and the culture of your organization.

Our job is to help you solve problems and to make you look good.

Venable: Comprehensive Support for Decision Making

We Know What You Deal With Every Day—We Understand What You Go Through in Applying Arcane Rules to the Benefits and Retirement Savings of Real People

When parts of your package need approvals by regulatory agencies, we take the lead in obtaining the clearances you need.

As you install the plan, we’re with you all the way—to transform the documents into a straightforward and practical system that you and your staff can manage with ease. As laws and regulations change, we’ll take the lead in making amendments that keep you in compliance. And should you decide to terminate or freeze a plan, we can assist you with that as well.

But Organizations Are Always Changing—Suppose You’re a Business That Needs to Make a Reduction in Force

We have designed window plans and other strategies that comply with tax, ERISA, and ADEA requirements to achieve the clients' goals. For example, when an international credit card company decided on a major reduction in force, we helped the consultants design the severance packages and worked with the actuaries to amend the company's defined benefit plan to provide for early retirement subsidies. We also designed and assisted with the implementation of several forms of employee communications for multiple categories of employees covered by differing plan terms.

Or Perhaps You’re a Business That is Looking to Acquire Other Companies

For several clients, we are regular members of the acquisition team—performing due diligence, negotiating acquisition agreements, writing proxy disclosures, harmonizing the targets’ benefits plans with the company’s structure, and designing severance plans for employees who are terminated in connection with the acquisitions.

Interest Rates are Falling, Pension Costs are Rising, You Need to Control Your Liabilities

For a consortium of grocery store chains, we crafted changes in the funding rules that apply to multi-employer pension plans. We helped guide the proposal through two House committees, two Senate committees, House and Senate floor action, and a very protracted House-Senate conference. With approval of the rule changes, the employers experienced significant reductions in costs.

While changes in multi-employer funding may not directly apply to your business, they are an example of the innovative thinking available at Venable to companies that are struggling with the escalating costs of employee benefits.

You’re a Nonprofit Already sponsoring—Or Thinking About Starting—a 457 Plan

Our Employee Benefits and Executive Compensation attorneys have particularly deep knowledge about the specialized—and often arcane—rules that apply to nonprofits and governmental employers. We structure deferred-compensation plans and other innovative programs that supplement retirement savings, so that governments and nonprofits can attract and retain key employees. Recently, we’ve counseled clients on the final 403(b) regulations and current trends in 457 plans that may impact the design and operation of an organization’s retirement plan.

You’ve Read That the Department of Labor is Cracking Down on Disclosure Issues

That’s correct. As the Pension Protection Act of 2006 kicks into gear, the Department of Labor will be looking into what employers are disclosing to employees about how well their plans are doing. Expect greater scrutiny of fiduciary oversight of investments and the costs of plan administration. That’s likely to be followed by a wave of litigation involving fiduciary responsibility.

We’re preparing Venable clients for the onslaught—with refresher courses on fiduciary duties, due diligence, and oversight, plus preventive measures that can help ensure they won’t run afoul of the new rules.

You’re Aware of the Push for Greater Transparency for Executive Compensation

As advisors to boards of directors and compensation committees, we help develop and negotiate employment agreements, incentive compensation, and other performance-based programs. With the disclosure rules in mind, we design plans that address all necessary reporting issues, whether these arise under the Sarbanes-Oxley Act of 2002, SEC mandates, stock exchange regulations, or state “blue sky” rules.

Employee Benefits Focus

- Retirement plans

- Defined-benefit plans

- Profit sharing, 401(k), and 403(b) plans

- Employee Stock Ownership Plans (ESOPs)

- Health and welfare plans

- Fiduciary responsibility and plan asset management

- Audits, Employee Plans Compliance Resolution System (EPCRS), and benefit plan correction programs

Executive Compensation Focus

- Deferred compensation programs and 409A

- Executive employment agreements

- Equity-based programs

- Severance plans and agreements

- Supplemental retirement programs

Industry Focus

- Aerospace and defense

- Banking and financial services

- Construction and engineering

- Direct response advertising

- Educational institutions

- Energy and utilities

- Foodservice and food retail

- Government contractors

- Governmental entities

- Healthcare and hospitals

- Hospitality

- Human resources and employment services

- Information technology

- Manufacturing

- Nonprofit organizations

- Satellites and communications

- Trade associations