The real estate world has its own cadence – space is designed and constructed; buildings are inspected and financed; and properties are marketed, listed, and sold.

Breakthrough companies entering the real estate space are upending this historical rhythm, leveraging innovative ways to structure transactions and offering revised deal structures. Furthermore, new entrants often utilize technology to increase the speed and efficiency of transactions while developing entirely new product categories.

It is not just PropTech companies (technology companies focusing on the real estate industry) adopting and creating new models – we are seeing significant innovation from traditional real estate companies looking to maintain leadership roles.

Here are three questions for the real estate industry in 2021:

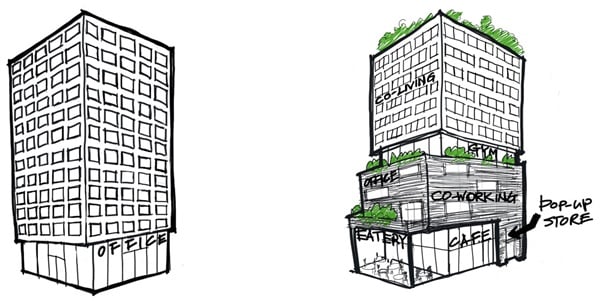

1. Can co-working and co-living models compete with traditional real estate?

Classic Real Estate and New Real Estate

(Illustrations by Teresa Jan)

Many new companies in the co-working and co-living space sign master leases or otherwise control large amounts of space and then sublease the space to individuals or smaller groups of users. This structure has dominated the co-working space boom and is also used effectively by co-living companies and in an array of similar and evolving structures. While this model is not entirely new, the scale and speed of these transactions has changed the product category.

While companies control the space, they are responsible under the terms of master leases and passing on appropriate risk to their users while respecting tenant protection laws – which is particularly challenging for platforms operating across the country and is accentuated in the age of COVID-19.

A string of recent bankruptcy filings by co-living companies has shown the challenges the industry faces, but some market leaders are persevering, particularly when their lease documents allow for flexibility, including rent resets and termination rights when properties are under-leased. We expect that the co-living companies that make it through this era will thrive as they face fewer competitors and benefit from lessons learned.

Similarly, the co-working world may benefit from shifts in how companies see office spaces in the wake of COVID-19. Long-term leases in downtown core markets will be less attractive to some, and co-working companies may benefit if corporate tenants shift to a hub-and-spoke office model.

2. How quickly will land use regulations adapt to the new real estate market?

Traditional land use rules favor defined categories written decades ago, before today's focus on co-working and co-living, short- and medium-term housing, pop-up stores and restaurants, outdoor dining in public spaces, and other mixed-use combinations. Cities continue to enact specific legislation to address new uses, imposing use controls, registration requirements, and gray areas that affect how old rules apply.

This reclassification is particularly true in the co-living space. San Francisco recently passed legislation regulating lease terms between one month and one year, with the goal of preventing real estate owners from converting long-term units into medium-term rentals. Regulators will continue to protect the current real estate model to the extent it benefits voters.

Furthermore, land use regulations continue to adapt to allow and even require more density. Portland, Oregon, and Minneapolis, Minnesota passed higher-density zoning requirements in the past year, and Berkeley, California recently proposed legislation to abolish single-family zoning entirely. These trends will continue and accelerate.

3. Is there a way to fully digitize closings and shorten the time it takes to complete a transaction?

A classic real estate transaction culminates in the recording of a deed that formally transfers ownership and provides public notice to cement legal rights. While providing certainty, this process takes time and a number of steps that contrast with the ease and speed of online transactions – many companies that tried to close deals at the outset of COVID-19 in the spring of 2020 found that recorder's offices across the country were shut, effectively blocking many closings.

Change will accelerate in this area as technology companies build new products for the real estate world. However, rate of change is limited because of recording statutes in place in each state that determine how ownership is perfected, and different policies on recording, taxes, and closing procedures in the 3,000 counties across the United States. Happily, many states have allowed or accelerated the transition to electronic signatures and remote notaries because of COVID-19, which removes one barrier to virtual closings.

As experts in the space, we frequently work alongside dynamic new leaders on how to apply proposed business models within the existing framework of real estate laws while simultaneously considering where existing regulations can be modernized.

Many of the companies we see in the PropTech and innovative real estate company space will change the landscape of legal requirements that apply to deals. The challenge is how to adapt our existing rules and regulations to shape that reality. We are ready.