Last week, the Department of Labor issued proposed regulations affecting associations that offer health plans for their member employers. The proposed regulations are limited to association health plans (AHPs) governed by the federal law known as ERISA. The proposed regulations would:

- Expand the types of associations that are allowed to offer ERISA-covered AHPs;

- Expand the types of employers that may participate in ERISA-covered AHPs;

- Make it more likely that AHPs qualify for the large-group insurance market, which has fewer requirements than the small-group insurance market.

We expect these regulations (if finalized) to result in more ERISA-covered AHPs, leading to increased employer participation in AHPs and possibly lower premiums for those individuals participating in them. In addition, we expect that new organizations will be formed to take advantage of the opportunities presented in the regulations.

The Problem that the Proposed Regulations Are Trying to Solve

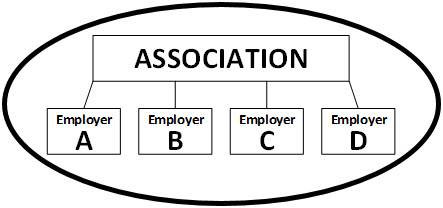

The current rules governing AHPs are very restrictive. Assume that an association offers an AHP to its employer members. If the Association follows certain rules, the arrangement is treated as one plan, with many participating employers, like this:

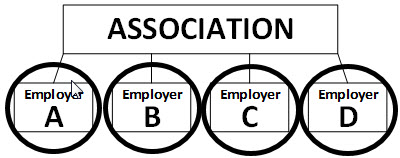

If the association does not follow those rules, the arrangement is treated as many separate plans, one plan per employer, like this:

Currently, very few AHPs are treated as one plan—most are treated as separate plans due to the existing stringent rules. The proposed regulations relax those rules so that more AHPs will be treated as one plan.

Why does it matter whether an AHP is treated as one plan or many plans? Premiums! Let's say that, in the images above, Employers A, B, C, and D each have 30 full-time employees. If the arrangement is treated as one plan, then under the Affordable Care Act, the plan has 120 participants and may be considered a large employer group. On the other hand, if the arrangement is treated as many separate plans, each with 30 employees, each separate plan must be considered a small employer group plan. The distinction is important, because large group plans generally have lower premiums than small group plans. (This is true for a number of reasons, which involve both the Affordable Care Act and state insurance law. More on that in a moment.)

What the Proposed Regulations Would Change

Some of the proposed changes are designed to expand the pool of associations that can offer a one-plan AHP to employer members.

- Currently, an AHP can be treated as "one plan" only if the association has a purpose or function unrelated to the provision of benefits. Under the proposed regulations, an association may sponsor an AHP even if its only purpose or function is to provide benefits.

- Currently, an AHP can be treated as "one plan" only if the employer members have a "common economic or representational interest." Under the proposed regulation, it is enough for the employer members (a) to be in the same trade, industry, line of business, or profession, or (b) to have their principal place of business in the same state or the same metropolitan area (even if the metropolitan area includes more than one state).

The proposed regulations retain the requirement that the association must be a business entity and must be functionally controlled by its members.

Other proposed changes are designed to expand the types of employers that can participate in AHPs.

- Currently, an AHP can be treated as "one plan" only if each participating employer has at least one employee who is not an owner (or related to an owner). Under the proposed regulations, sole proprietors and other self-employed individuals may participate in AHPs. The sole proprietors and other self-employed individuals must dedicate a certain amount of time to the business, or earn a certain amount of income from the business, and must not be eligible for a group health plan sponsored by another employer.

The proposed regulations also include nondiscrimination provisions. For example, the association cannot restrict membership based on any health factor, and the AHP cannot determine eligibility or premiums on the basis of any health factor. Other eligibility rules (for example, part-time employees may not be eligible) must be applied equally to all participating employers.

Issues Outside of the Proposed Regulations

Consumer Protection. Consumer advocates are wary of the proposed regulation for two reasons. First, an association may offer an AHP with limited benefits (for example, no coverage of cancer) that will attract only employers with relatively healthy employees. If many healthy employer groups and self-employed individuals leave the small group and individual markets, the premiums in those markets may increase—perhaps dramatically. Second, employers and individuals may enroll in an AHP with limited benefits without fully understanding the plan's limited coverage.

State Insurance Law. Health insurance is subject to both federal and state law, and their interaction is often complicated. It is important to remember, however, that state insurance departments have considerable control over AHPs, including those that are self-funded. The proposed regulations allow the states to relax their rules on AHPs, but do not require them to do so. It is too soon to know how state insurance departments will react to the proposed rules.

Multiple Employer Welfare Arrangements (MEWAs). AHPs are a type of MEWA. The proposed regulations do not change the definition of a MEWA, the federal rules affecting MEWAs generally, or the scope of federal or state authority over MEWAs. As described more fully above, the proposed regulations do change the standards for deciding whether certain MEWAs—AHPs—are considered a single plan.

What Happens Next?

Comments on the proposed regulation are due no later than March 6, 2018. There is no deadline by which the Department of Labor must issue final regulations. However, AHPs have been a much-discussed priority for the Trump administration, and we would not expect a long delay.

If you have questions regarding the proposed regulations or their impact on your association or company, or are interested in submitting a comment, please contact any of the authors or your regular Venable attorney.