This article was featured in the March 2010 issue of The Independent Counselor.

The role of credit counseling agencies in assisting consumers in financial distress has received a lot of positive government and media attention. Before the economic crisis, the public most often heard about credit counseling only in the context of broader discussions about consumer debt and repayment alternatives or bankruptcy.

Now the stories are focused on how counseling services are making a difference in the lives of consumers and of the government and credit counseling agencies working together. The President, Congress, state and local officials have all turned to credit counseling agencies to assist consumers in financial distress with services such as housing counseling, budget counseling, financial literacy and more.

Everyone in the credit counseling sector can cite examples, big and small, of how credit counseling agencies are relieving the burdens of government and providing needed services to consumers. Further, consumer need and government mandates on the industry to address credit and debt issues outpace public grant money and funding from other sources.

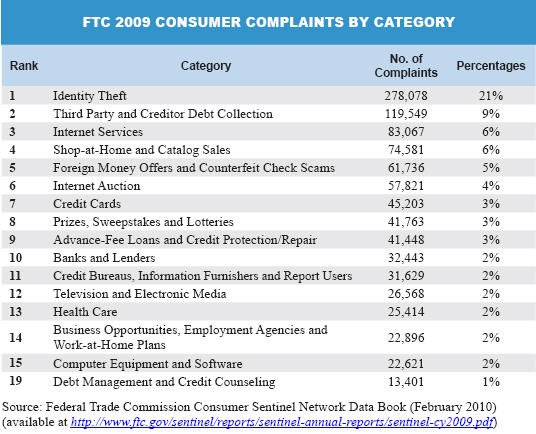

But at the same time, complaints of consumer fraud related to credit and debt is on the rise. According to a recently released report by the Federal Trade Commission (“FTC” or “Commission”), the top complaints filed by consumers last year with the FTC were:

As the above chart shows, about 24% of all complaints logged over the past year were related to credit and debt categories (See #2, 5, 7, 9, 10 and 11 above).

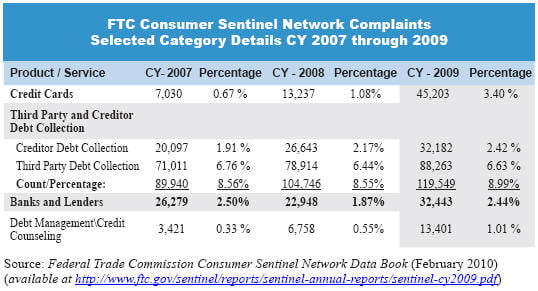

Interestingly, however, the report shows that while financial related services are spurring complaints, debt management and credit counseling were toward the bottom, ranking 19th out of 30 primary categories that are tracked. In fact, complaints specifically about credit counseling were lower than those of credit cards, debt collectors, banks and lenders and nearly two-thirds of the all other categories. While the FTC’s report is just one barometer of what consumers are encountering, a closer look at the numbers shows just how dramatic the differences are among some of the categories.

It is against this backdrop that the FTC recently announced that it has stepped up efforts to protect consumers affected by the economic downturn with increased outreach and enforcement. The FTC also has requested additional authority to make the agency “more effective.”

For example, the FTC and other governmental agencies and national consumer groups kicked off National Consumer Protection Week (“NCPW”) on Monday, March 7. For the week, the FTC and its partners have taken a page from the mission of consumer credit counseling agencies and adopted a theme of “Dollars & Sense: Rated “A” for All Ages.” NCPW 2010 promotes free resources to help people protect their privacy, manage money and debt, avoid identity theft, understand credit and mortgages, and steer clear of frauds and scams.

Perhaps more importantly, however, is the FTC’s ongoing enforcement activities. For example, the FTC and state Attorney Generals have launched a coordinated enforcement effort to shut down mortgage loan modification companies that charge up-front fees and allegedly provide little or no services. Combined, federal and state law enforcement agencies have brought well over 100 cases against such advertisers within the last year. In addition, the Commission has brought over nineteen lawsuits against for-profit debt relief companies, including five in the last year. The FTC and states also have actively pursued cases involving credit repair, economic stimulus, debt collection and credit card marketing, to name a few.

Further, the FTC is in the process of formulating new rules to address unfair or deceptive practices in mortgage assistance relief services, mortgage advertising and servicing, and debt relief services. Also, in conjunction with the federal banking agencies, the FTC is considering additional rules to protect the privacy of consumers’ sensitive financial information.

All this is within the background of a larger debate concerning the Commission’s scope of authority. At the end of last year, the House of Representatives passed a bill that would expand the Commission’s authority as a part of H.R. 4173, the Wall Street Reform and Consumer Protection Act. That bill would grant the Commission broader powers, including new rulemaking and independent litigation authorities. The Senate is expected to address these issues through FTC reauthorization legislation, which would likely be considered separately from the Senate’s financial reform legislation. Depending on what happens, the two bills would likely be married on the Senate floor at a later date.

Considering the number of consumers in need and the demand for services, the government and others ought to increase their financial support for counseling. In the meantime, the FTC and state Attorneys General are especially active in policing debt related services. Even Congress is poised to potentially enhance the FTC’s authority in this area (even if it does not create a new “Consumer Financial Protection Agency”). For credit counseling agencies, the takeaways are relatively straightforward: (1) continue to focus on education and counseling; (2) ensure complaints remain low; (3) continue to comply with federal and state law; and (4) seek to educate policymakers to avoid unintended consequences of regulations intended to protect consumers.

* * * * * *

Jonathan L. Pompan, an attorney in the Washington, DC office of Venable LLP, represents nonprofit credit counseling agencies and others in a wide variety of areas including regulatory compliance, as well as in connection with federal and state investigations and law enforcement actions. For more information, please contact Mr. Pompan at 202.344.4383 or jlpompan@Venable.com.

For more information about this and related industry topics, see www.Venable.com/ccds/publications.

This article is not intended to provide legal advice or opinion and should not be relied on as such. Legal advice can only be provided in response to a specific fact situation.