UPDATE: A look inside the official CFPB Enforcement Policies and Procedures Manual can be viewed here.

When companies are faced with a Consumer Financial Protection Bureau (CFPB or Bureau) investigation and threatened with litigation over alleged violations of consumer financial law, often there is the potential to reach a negotiated settlement. But settling a CFPB enforcement action presents a number of unique challenges, including the CFPB's internal priorities and philosophy regarding the use of negotiated settlements to resolve enforcement matters. This article examines these dynamics.

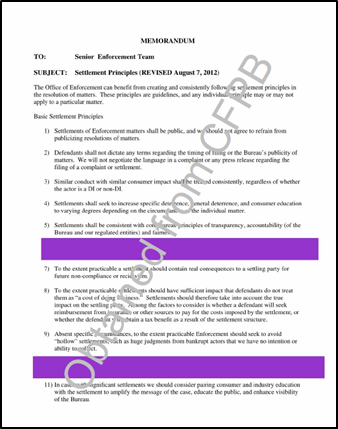

Our observations are based on our personal experience defending companies before the CFPB, including having secured the closing of investigations on a nonpublic basis, a review of the Bureau's public enforcement actions brought to date, and the CFPB's internal guidance on the topic. For instance, it maintains an Enforcement Policies and Procedures Manual (Manual) to impose administrative structure and uniform standards on how enforcement staff achieve their mandate to enforce federal consumer financial laws.

The Bureau's Broad Investigatory and Enforcement Reach

The CFPB is charged with implementing and, where appropriate, enforcing "Federal consumer financial law" with the goal of "ensuring that all consumers have access to markets for consumer financial products and services and that markets for consumer financial products and services are fair, transparent, and competitive." "Federal consumer financial law" is a defined term that includes eighteen enumerated consumer laws enacted prior to the Dodd-Frank Act, including, for example, the Electronic Fund Transfer Act, the Fair Credit Reporting Act, and the Truth in Lending Act.

The CFPB has authority to bring an enforcement action for any unfair, deceptive, or abusive act or practice (UDAAP) involving consumer financial products or services, and for conduct that violates any of the eighteen enumerated consumer financial laws.

The Bureau can investigate merely on suspicion that any person has violated any provision of federal consumer financial law, or to seek assurance that a violation has not occurred. In other words, it is not necessary to have evidence that a law has in fact been violated before opening a formal Investigation. In fact, according to the Manual, the Bureau could conduct a compliance sweep to investigate whether industry participants are complying with a law or regulation.

Understanding the Bureau's Settlement Priorities

The Manual sets out the Bureau's policies on initiating investigations, drafting civil investigative demands and taking testimony, closing investigations, seeking a settlement or filing a lawsuit in court or the administrative forum, how to analyze statute of limitations, when to seek a tolling agreement, seeking civil money penalties, sharing and gathering information from third parties, including banks and Internet Service Providers, and more.

The CFPB also has developed specific settlement principles to guide enforcement staff during investigations and settlement talks. Although CFPB staff are given leeway and discretion to adjust their negotiations in response to particular facts and circumstances, an examination of a number of consent orders, as well as our own personal experience, reveals that enforcement staff typically closely follow these principles. Nonetheless, there's no substitute for tough negotiation, recognizing that every fact situation is different, and that the ultimate resolution of an enforcement matter once alleged violations of law are made depends on each party's perception and understanding of litigation risk and specific facts.

Below we summarize some of our observations regarding what drives the Bureau's settlement posture:

- Settlements must be public; the CFPB does not appear willing to agree to private settlements.

- Timing of filings or the Bureau's publicity of matters and the language in a complaint or any press release may not be negotiable.

- Similar conduct with similar consumer impact is supposed to be treated consistently.

- Settlements should aim to meet the goals of increasing specific deterrence, general deterrence, and consumer education. As such:

- Settlements should sufficiently impact the settling party and not be treated simply as a cost of doing business. For example, the CFPB typically limits the party's ability to seek reimbursement from insurance or other sources to pay for the costs imposed by the settlement, or to obtain a tax benefit as a result of the settlement structure.

- Settlements should avoid being "hollow" or otherwise not enforceable (for example, if the settling party has filed for bankruptcy and is unable to pay the assessed penalty).

- Announcements of settlements often are accompanied by publications of compliance bulletins or other forms of consumer or industry guidance.

- Settlements should be transparent, accountable, and fair.

Not surprisingly, these settlement principles reflect the "regulation through enforcement" stance of the CFPB. As a result, companies faced with an investigation and alleged violations of consumer financial law may face an uphill battle to get the enforcement staff to focus on the specific facts of an investigation.

Negotiating a Satisfactory Resolution

When considering settling a CFPB enforcement action (and when responding to an inquiry), companies need to understand the range of these issues and positions in order to develop an appropriate strategy, set realistic expectations, and, if possible, reach a satisfactory agreement.

Based on our review of guidance to enforcement staff, consent orders and litigation, and our own experience, the following strategies may be useful:

- Engage in every opportunity to advocate for your position by framing the issues in the best possible light. Although most interactions will be with enforcement staff assigned to the case, there are multiple points of review and approval by supervisors and stakeholders from other departments in the Bureau throughout the process. It is therefore important to take every opportunity to prevent an investigation from gaining momentum, and to understand the full extent of the CFPB views on products and services being reviewed.

- Maintain an open dialogue with the Bureau staff, who have a significant amount of discretion in the day-to-day aspects of an inquiry, if they decide to use it.

- Do your research – understand CFPB precedent or enforcement actions in other, similar circumstances that you can use to press your case.

- Analyze the data that may be used by the Bureau to calculate consumer harm and understand potential civil money penalty (CMP) calculations.

- The CFPB manual makes clear that guidance from other agencies, including "Civil Money Penalty Matrices" published by other banking regulators, may be used for reference. But enforcement staff are directed that they "should rely primarily on [their] calculation of the statutory daily maximum, Bureau precedent, and other statutory factors in determining the appropriate CMP in [their] case." As a result, a CMP assessed by the CFPB has the potential to be far greater than one assessed by other agencies for the same or a similar alleged violation of law.

- Understand the Bureau's settlement priorities and attempt to address them in each proposal or offer made.

- It is looking to make a big impact (and headlines).

- It will reject any approach blatantly designed to neutralize the consequences of the settlement for the settling party.

- It is seeking to maximize deterrence and consumer education.

* * * * * * * * * *

Related Articles

- What to Expect When You're Under a CFPB Investigation – Negotiating the Scope of the CID

- What Lead Generators Need to Know about the Consumer Financial Protection Bureau (CFPB)

- Government Puts Squeeze on Lead Generation Marketing

- Minimizing Legal and Compliance Risk for Credit Furnishers

- Navigating CFPB Debt Collection Investigations and Enforcement Actions

- Managing Evolving CFPB Regulatory Risk through Effective Change Management

- Understanding Federal and State AG Financial Services Enforcement Trends

- Preparing for a CFPB Examination or Investigation

For more information, please contact Jonathan L. Pompan at 202.344.4383 or jlpompan@Venable.com.

Jonathan L. Pompan, Partner and co-chair of Venable's CFPB Task Force, Andrew E. Bigart, and Alexandra Megaris advise on consumer financial services matters and represent clients in investigations and enforcement actions brought by the CFPB, FTC, state attorneys general, and regulatory agencies.

For more information about this and related industry topics, see www.Venable.com/cfpb/publications.

This article is not intended to provide legal advice or opinion and should not be relied on as such. Legal advice can be provided only in response to a specific fact situation.