An internal Consumer Financial Protection Bureau (CFPB) playbook and memo reveal how key decisions are made throughout the examination process, who is responsible for making those decisions, how information is evaluated, and the intersection between CFPB examinations, investigations, and enforcement.

An internal Consumer Financial Protection Bureau (CFPB) playbook and memo reveal how key decisions are made throughout the examination process, who is responsible for making those decisions, how information is evaluated, and the intersection between CFPB examinations, investigations, and enforcement.

Although many institutions supervised by the CFPB look to the CFPB Supervision and Examination Manual and Supervisory Highlights to know what to expect during examinations, even companies accustomed to government examination can find the process to be particularly opaque and confusing. To shed light on the CFPB examination process, we obtained through a Freedom of Information Act (FOIA) request the CFPB's Supervision, Enforcement, and Fair Lending (SEFL) Examination Playbook (Playbook) and SEFL Integration Memorandum (Memorandum). A copy of the Playbook and Memorandum are available for download here.

The documents show that the outcome of a CFPB examination will depend on multiple decision makers, at various stages, and the importance of such factors as the exam findings and matters requiring attention, whether there is a violation of law, deterrence, variety of products and potential violations, size and complexity of the institution, self-correction, history, and cooperation. Companies that disagree with the examination findings should provide substantive input and objections to the findings, present additional information and documentation at the earliest stages possible, and consider appropriate remediation steps, if any.

The Examination Process

The Playbook identifies and describes the key decisions that arise at each stage of the examination process, as well as who within the CFPB is responsible for making and implementing each key decision. The purpose of the Playbook is to provide guidance to decision makers on their roles and responsibilities, referred to as "decision rights," throughout the examination or target review.

As outlined by the Playbook, the examination process is composed of four stages: scoping, on-site analysis, off-site analysis, and report review. An overview of each of the activities that are conducted at each stage is provided below, as are key decisions and corresponding decision rights.

Scoping

Scoping involves setting examination priorities and schedules across markets and for individual examinations. It also includes conducting pre-examination activities such as preliminary information requests and determining the scope of the examination. Key decisions that arise during this stage, and relevant decision makers, include the following:

- Examination Priorities. The Assistant Directors (ADs) for the Office of Supervision Policy (OSP) and the Office of Fair Lending (FL) are responsible for determining examination priorities.

- Examination Schedule. Regional Directors (RDs) in the Office of Supervision Examinations (OSE) are responsible for determining the timing and sequence of examinations for the calendar year.

- Specific Scope and Schedule. The Examiner-in-Charge (EIC) is responsible for making decisions regarding the scope of the examination, the preparation of the Information Request, and the examination schedule. These decisions involve determining which activities will be conducted during the examination and relevant modules, and which items of information are pertinent to the examination of the particular institution.

On-Site Analysis

On-site analysis involves conducting interviews, observing the institution, transaction testing, and other examination processes that assess the institution's compliance with federal consumer financial laws and potential violations. After the on-site examination is complete, additional time may be granted for the off-site analysis of relevant factual findings and other information.

- Formal Documentation and Modifications. The EIC is responsible for making decisions regarding formal documentation of the examination, including appropriate work papers and Fact Verification Memoranda. These decisions involve identifying and clarifying examination procedures and findings. The Field Manager/Senior Examination Manager (FM/SEM) is responsible for making decisions regarding modifications to the scope of the examination once it has commenced.

- Initial Examination Findings. The EIC is responsible for conducting the closing meeting and making related decisions, including any preliminary examination findings, expected corrective actions, recommended rating, or next steps. The EIC is also responsible for preliminarily deciding whether an examination is "clean"—i.e., does not involve any potential violations of federal consumer financial laws—and eligible for review on an expedited track. The Assistant Regional Director (ARD), the OSP AD, and the Office of Enforcement (ENF) are responsible for approving review of an examination on an expedited review track.

Off-Site Analysis

Off-site analysis involves escalating potential violations of federal consumer financial laws discovered during the examination and determining whether an enforcement or supervisory action should be pursued. It is at this stage that collected information and findings can lead to an enforcement action.

- Interpretations of Non-Routine Questions of Law. If an examination involves potential violations of federal consumer financial laws, the OSP Program Manager is responsible for determining whether an interpretation is required, and for framing the potential violations through preparation of a memorandum seeking the interpretation. For non-routine questions of law, the Legal Division is responsible for determining whether a violation has occurred, except where the question of law involves a regulation – then the Office of Regulations is responsible for the determination.

- PARR Letter. A Potential Action and Request for Response (PARR) Letter notifies the institution that the CFPB is considering whether to propose a supervisory or enforcement action, based on preliminary findings of potential legal violations. The FM/SEM is responsible for determining whether a PARR letter should be sent. The OSP Program Manager is responsible for drafting the PARR Letter, which is approved by the RD.

- ARC. Decisions on whether potential legal violations should be escalated to the Action Review Committee (ARC) are also made by the FM/SEM, who drafts the ARC memorandum to support the ARC's evaluation of relevant facts and law in determining whether public enforcement is appropriate. The ARC evaluates over thirteen factors spread among four categories: violation, institution, policy, and justice. The RD is ultimately responsible for approving the ARC memorandum. The ARC then recommends to the Director whether the matter should be handled through the supervisory process or public enforcement action.

Report Review

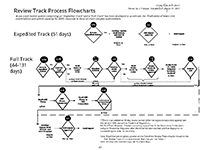

Once an examination report is prepared, the review process depends on whether it is scheduled for expedited or full review.

Once an examination report is prepared, the review process depends on whether it is scheduled for expedited or full review.

- Expedited Review. Under the expedited track, the examination report is reviewed by the FM/ SEM and the OSP Program Manager and Deputy AD. The ARD is responsible for collecting input from the OSP POC and finalizing the report, which is then approved by the RD.

- Full Review. Under the full-review track, the examination report is reviewed by the FM/ SEM, the OSP Program Manager and Deputy AD, the Legal Division, and staff of the Office of Enforcement. The ARD is responsible for collecting and incorporating input, and finalizing the report after the content has been reviewed and ratified by the OSE AD, OSP AD, RD, and SEFL Associate Director.

In addition to providing further information on key decisions throughout the examination process, the Memorandum contains sections on:

- SEFL Coordination and Prioritization: Includes information on SEFL strategy, information sharing and scheduling, and tool choice (i.e., oversight through examination or investigation)

- Enforcement Attorneys' Role in Examination Work

- Action Review Committee (ARC) Process

- Compliance and Disposition of Required Actions

Supervisory Appeals

The Playbook and Memorandum do not provide any information or guidance on the examination appeals process, which remains an area for which the CFPB has not provided any public statistics and there is little substantive transparency. That said, in our experience, the appeal of supervisory matters benefits from having a robust submission of relevant information during an examination, and doing so can help to stave off an enforcement recommendation. The CFPB appeals policy states that only facts and circumstances upon which a supervisory finding was made will be considered by the appeals committee, and that it is an appellant's burden to show that the contested supervisory findings should be modified or set aside.

* * * * * * * * * *

Prior to the establishment of the CFPB depository, institutions were the only members of the consumer finance industry subject to federal supervision. The paradigm shifted with the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act), which vested the CFPB with broad regulatory powers, including the authority to examine certain non-depository institutions for compliance with the federal consumer financial laws.

The CFPB has supervisory authority over depository institutions with over $10 billion in assets, as well as payday lenders, mortgage companies, private student lenders, and larger participants of other consumer financial markets, such as debt collection and credit reporting. In accordance with the Dodd-Frank Act, supervision is risk-based, and in exercising its authority the CFPB must focus on the institutions and products that pose higher degrees of risk to consumers. Through examinations, the CFPB is responsible for assessing institutions' compliance with the federal consumer financial laws and detecting risks posed to consumers and markets for consumer financial products and services.

* * * * * * * * * *

Jonathan L. Pompan, Partner, Alexandra Megaris, Counsel, and Katherine M. Lamberth, Associate, advise on consumer financial services matters and represent clients in examinations, investigations, and enforcement actions brought by the CFPB, FTC, state attorneys general, and regulatory agencies.